Our Services

We specialize in forming lifelong partnerships with our clients by providing quality planning and investment advice, along with excellent client service. These are the main services we provide for our clients:

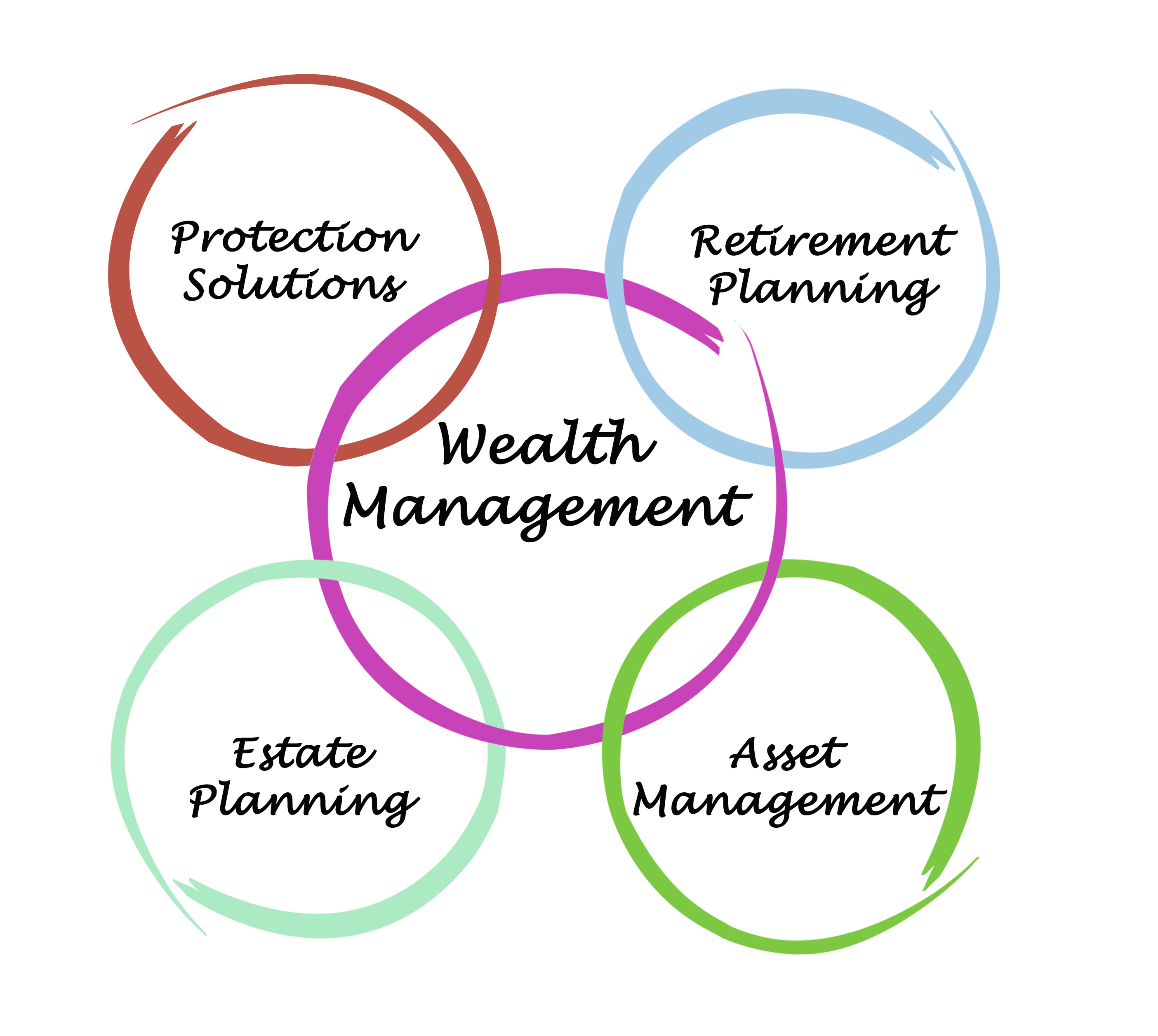

Wealth management entails a careful blend of investment expertise, client understanding and dedication to achievement. If needed, we introduce you to experts we know and trust in the areas of accounting, estate planning, insurance, real estate and lending, if any of these fields are relevant to your situation. We act as the team coordinator to ensure that you optimize your family legacy.

Businesses

Investment Consultants to 401(k) Plans

EYH has been advising and managing pension plans since 1986. As a Registered Investment Adviser (RIA), we act as a co-fiduciary to your Plan.

As Investment Counselors to your Plan these are some of the services EYH provides: